Why India Bulls Housing Finance (IBULHSGFIN) Rallying more than 50% in two days

Jun 22, 2020India Bulls Housing Finance (IBULHSGFIN) is up by more than 50% in just two days of time. It has shown a vertical rise in the form of 3rd wave that we anticipated and gave Momentum call on this stock just before the rise.

A different BULL as the name itself suggests. This stock is up by more than 20% in today’s session and again this is no surprise to us.

We generated buy call on IBULLHSGFIN on 19th June 2020 and it gave a return of more than 50% in just two days of time. This was under the Momentum services.

The only way you can measure the sentiments objectively for forming trading or investment decision is by using Elliott wave patterns.

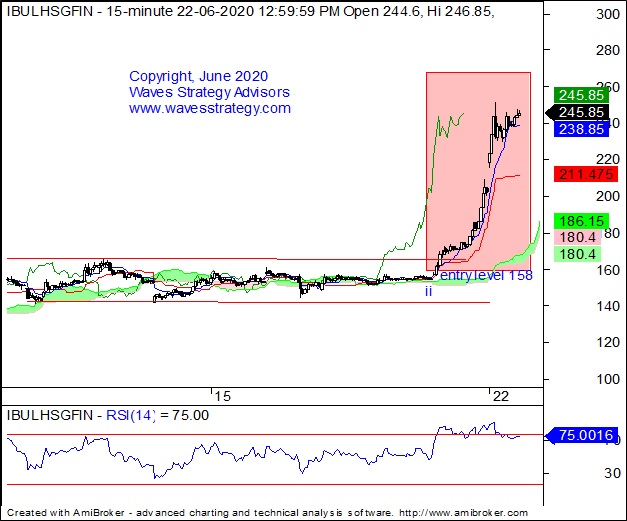

See below what did the chart suggests:

IBULHSGFIN hourly chart: Momentum call given on 19th June 2020

Why India Bulls Housing Finance (IBULHSGFIN) Rallying more than 50% in two days

IBULHSGFIN 15 min chart (Happened till now)

(Following research is taken from Momentum report published on 19th June 2020)

Momentum stock recommendation: India Bulls Housing Finance

Buy Price – Buy above 158

Time Horizon –Not Applicable

Investment – 5% of capital

Target price –174

Partial Profit: 165

Stop loss–148

Elliott wave analysis:

IBULLHSGFIN exhibited classic pattern break out of its prolonged broad range of 140-155 levels. This amazing momentum in the stock help us to achieve our targets within a day itself post the breakout was seen. After the call was given the stock is up by more than 30% in single day.

On the hourly chart, overall wave count is suggesting that the stock is moving in the form of impulse pattern. Currently wave (iii) which is the strongest pattern is unfolding on the upside.

As per Ichimoku cloud, there was a positive confirmation since prices managed to break above the cloud from its consolidation phase. Now the cloud would act as perfect support and we could see movement in upward direction.

In short, we gave buy on IBULL above 158 levels and it achieved the target of 174 today itself which was more than 10% in just few hours of time. Prices infact crossed sharply above that level and rallied towards 200 levels up by 30% in single day itself. This is power of Elliott wave, Neo wave, Ichimoku Cloud and Cycle analysis.

Happened: The stock rallied more than 50% in just two trading sessions and we achieved our target of 174 levels. It simply shows power of Elliott wave patterns that we use for most of our research. In today session, prices have retraced up to 61.8% of the entire fall making intraday high near 254 levels.

Momentum calls: During such times it is important to capitalize by buying the stocks that can show momentum along with broader market. Always remember not every stock will move the way we expect but it is important to maintain strict stoploss as these are high risk trades but with potential to give the max gain in shortest possible time. Get access now