Pidilite Industries: Multibagger Stock Giving 57% returns

Feb 04, 2020We published about Pidilite ltd in November, 2018 and predicted a possibility of Multibagger returns in coming 3-4 years. This stock has managed to outperform the market giving almost 57% returns in just a year time and made a life time high near 1574 levels on 03rd February 2020

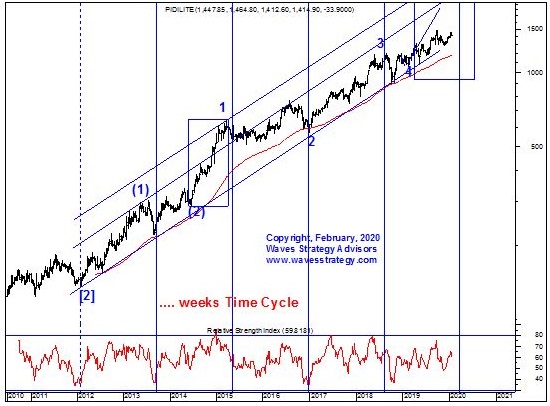

Below is the chart which shows a detailed analysis of Pidilite which helped to predict this target levels using Channels, Moving Averages and Elliott Wave technique. We recommended this stock when it was quoting near the 1160 levels and was successfully able to catch the upmove. See yourself how we were able to catch the upmove even before it began.

Below is the chart showing detailed analysis published in our research report –“The Financial Waves Multibagger Update”

Pidilite Industries Limited weekly chart: (Anticipated as on 30TH November 2018)

Pidilite Industries Limited weekly chart :(Happened as on 04th February 2020)

(Following research is taken from Multibagger report published on 30th November 2018)

Multibagger stock recommendation: Pidilite Industries

Buy Price – Buy at CMP 1160 and more on dips to 1000

Time Horizon – 2 years

Investment – 5% of capital

Target price – ??

Stop loss – ??

Anticipated as on 30TH November 2018– Elliott Wave Theory: Pidilite is a classic example of impulse method and has shown exceptional rise from its low made near 130 levels in form of wave [2]. Currently we are in cycle degree wave [3] within which primary wave (3) is ongoing. This primary wave is subdividing further and we are currently in wave 4 of (3). Post completion of wave 4 the uptrend should resume towards higher levels. We can expect a dip towards … levels in form of wave 4 and then a push towards upper levels can be witnessed. This gives a right opportunity to enter into this stock for investment purpose as it will allow capturing wave 5 move towards ….. levels.

Channeling Technique: Prices are moving precisely within upward slopping blue channel and has taken multiple times support on lower trendline indicating its importance. Even now when domestic market witnessed a selling pressure this stock found support near the lower trendline and closed above it.

Importance of 100 weeks Moving average: This stock has been following 100 weeks Moving average very well since 2012. We can see that whenever prices arrived near 100 days moving average stock started to move higher

Time Cycle: We are showing 85 week’s Time Cycle which has managed to capture major lows of this stock. The low formed near 900 was also near this cycle line. So considering the past behaviour we can expect range-bound to positive action in coming session as prices are currently in the first half of the cycle.

In nutshell, it is ideal to accumulate Pidilite as it has continued to sustain its important support levels and outperform irrespective of market conditions.

Happened as on 04th February 2020 – The stock has been moving in sync with our expectation and currently quoting near 1577 levels. It has touched its new lifetime high near 1574 levels on 03rd February 2020. The upmove has been strong and we expect pricesto achieve its target of …..levels in coming months. The stock is giving a return in excess of 57% in just One year of time

As a long term buyer of equity one should not wish for market to go up in straight line. It’s the volatility that creates opportunity to earn exponential returns. Get access to our Multibagger report to know here to invest next! That will help you capture such strong trend and earn exponential returns even in such market conditions. Check here.

In the upcoming online Mentorship module I will set strong foundation for identifying such outperformers yourself. Register here