Nifty Intraday Trading Using Gaps, Candlesticks, Bollinger Bands®, Option charts

Dec 09, 2021

Like this Article? Share it with your friends!

Nifty had been showing wild swings in either direction over the past few weeks and is now on verge of breaking above 17500 levels. There is no positional trend lasting for more than 2 to 3 days and during such time it is best to stick with Intraday trade setups.

By using simple methods of Gap, Candlesticks and looking at Option Intraday charts one can form good trade setup for Buying options.

See the below research on Nifty spot chart and Options chart

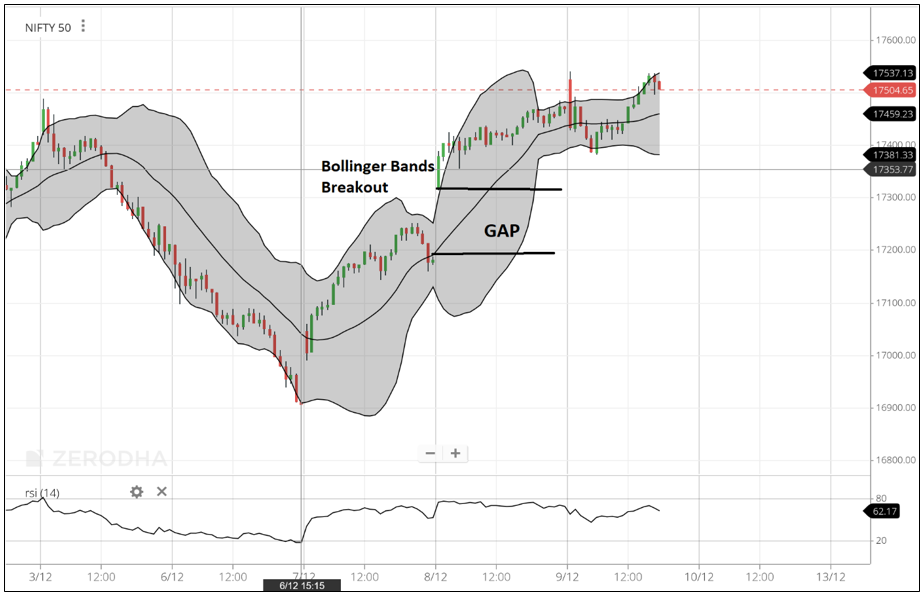

Nifty spot 15 minutes chart:

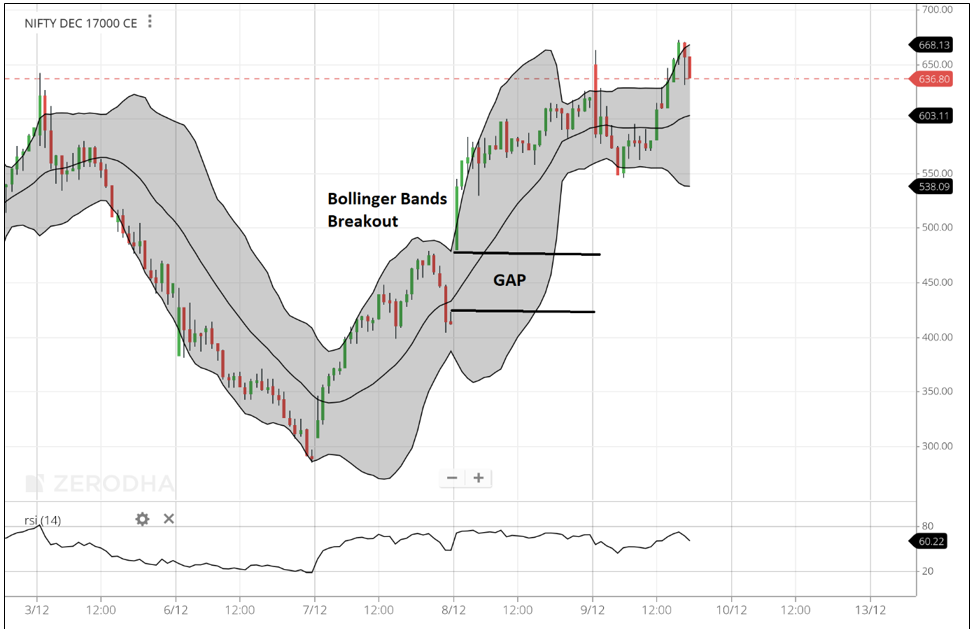

Nifty 15 minutes Option chart:

Above chart of Nifty spot and Options clearly shows Breakout Gap accompanied by Bollinger Bands expansion on 15 minutes time frame.

Gaps provide important information for traders and if it is accompanied by one more indicator it can increase the conviction sharply. Also understand that one has to be fast and quick in execution when trading in Options to ensure not to miss out the move.

A close of a candle above the upper end of the Bollinger Bands and next candle taking out the high clearly confirmation Bollinger Bands breakout strategy.

This happened near 530 levels on options and prices since then moved towards 620 on the same day. This is a move of nearly 17% on Intraday basis. The risk was the upper end of the Gap area which was near 470 levels, so the total risk was 60 points.

Above clearly shows that by combining Candlesticks, Bollinger Bands and Gap strategy can provide amazing trade setups on Options.

Option Trading Using Technical Analysis – OTTA Learn to Trade using such simple and powerful methods of options by forming Strategies like Straddle, Strangle, understand Open Interest analysis, Volume profile, Option chain and start trading with clearly defined trade setups from the very next day. Two days of Live event starts on 11th – 12th December 2021 and you cannot miss this opportunity that can transform you as a trader leveraging options as the tools. Register here