Nifty - 2 Powerful Indicators, You Cannot Miss!

Aug 22, 2022

Like this Article? Share it with your friends!

Nifty has shown a fall of more than 460 points since 19th August 2022 and was able to capture most of it.

We published Nifty analysis in "The Financial Waves Short Term Update" Check out below the detailed research report that we published.

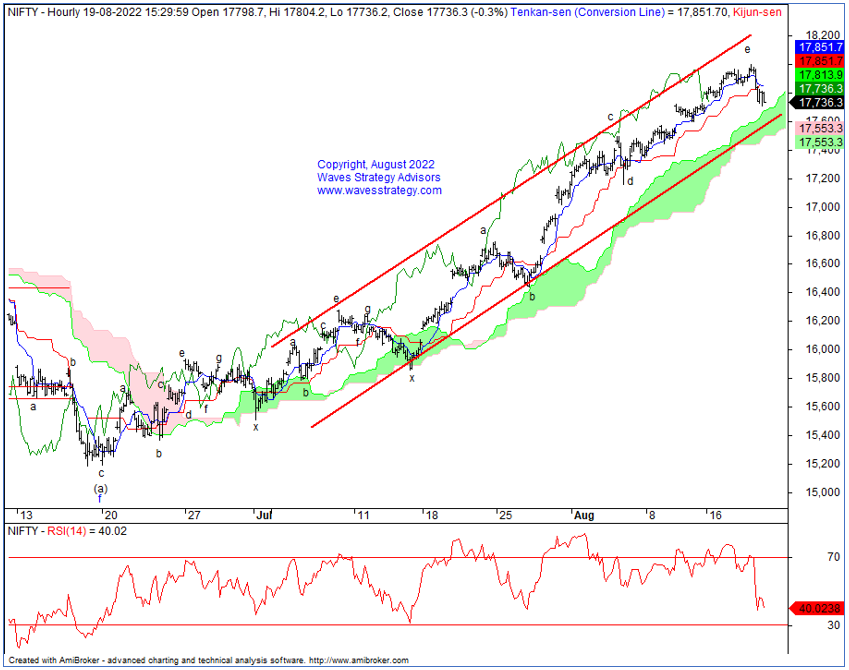

Nifty Daily chart (22nd August 2022):

Nifty 60 mins chart (22nd August 2022):

Wave analysis as we published on 22nd August 2022

On the weekly chart, Gravestone Doji has formed. The prior top was formed in a similar fashion. However, if prices manage to give close below previous week’s low then it will be a sign of weakness.

On the daily chart, for the first-time prices have closed below prior day’s low. In the previous session, outside candle has formed which suggest that trend is still bullish as long as we do not see a close below Friday’s day low. Prices have also taken exact support of channel. However, break of this support can suggest that further correction can be seen.

On the hourly chart, as per OI data aggressive call writing was seen at 17900 and 18000 strikes. It Is soon to conclude anything. Today is going to be an important day as it will confirm further trend. If prices close below 17690 then further correction can be seen in form of wave f.

In a nutshell, any break below 17690 can drag the price lower towards 17550 (which is an important support level. Whereas, for the upside 18000 can act as a major hurdle.

BANG ON!

Happened: Earlier in the report, we had mentioned that, any move below 17690 can further drag the price lower towards 17550. In today’s session Nifty had a gap down opening and have shred more than 220 points. Further, Nifty made a low of 17467 levels!

Subscribe to Equity calls and get a free daily equity research report “The Financial Waves Short Term Update” that provides a clear strategy using Elliott Wave and indicators on Nifty, Bank Nifty, and stocks. Get access over here

Master of Waves (MOW) – Learn complete Elliott wave, Neo wave along with Time Cycles and equip with excellent trade setups for trading Intraday and positional along with forecasting the markets from very hour, day and months. 2 Days of Live event on 17th – 18th September 2022, Know more here