Nifty Crashed - Was it predictable using Neo wave?

Jan 05, 2023

Like this Article? Share it with your friends!

Nifty Crashed - Nifty moved sharply lower today, was it predictable using a simple technical analysis study and advanced Elliott - Neo wave pattern.

Elliott wave and Neo wave are powerful technical analysis methods that can help traders with the complete setup right from Intraday to positional trades.

Below shows Nifty Neo wave count along with Bollinger Bands. This research is picked up from the daily Equity research report “The Financial Waves short term update”

Nifty Daily chart

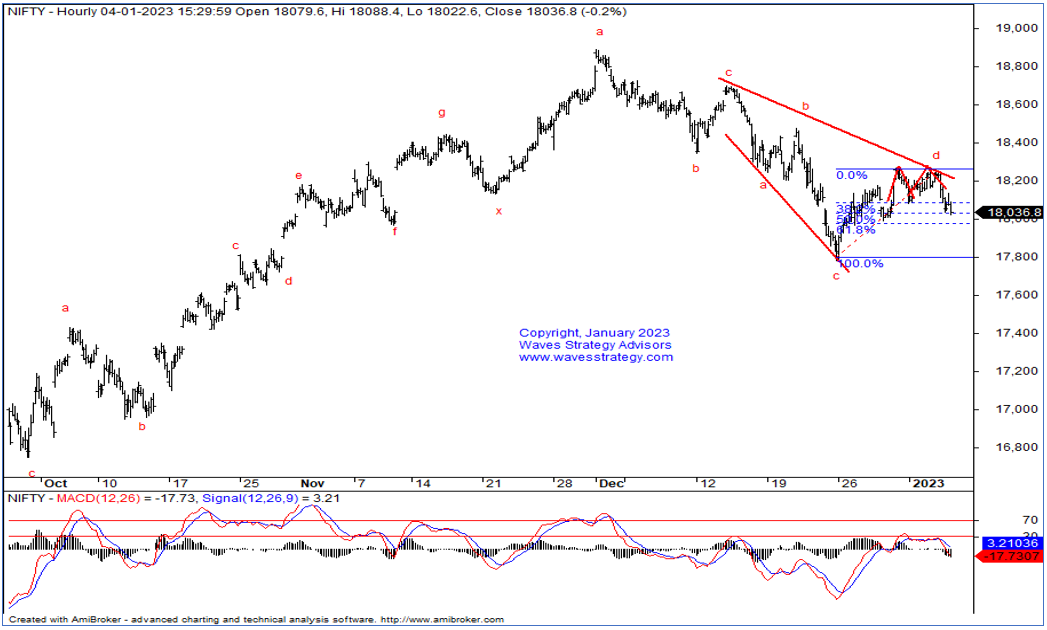

Nifty 60 mins chart

In the previous session, Nifty opened on a flat note. Nifty witnessed a sharp selling after opening hour itself. Nifty remained under pressure for the whole day. At the end of the day, prices closed with a loss of-1.04%. Amongst the stock Maruti, HDFC Life, Eicher Motors were amongst the top gainers by NSE. Whereas Hindalco, JSW Steel, Coal India, M&M lost the most and remained in the top losers list by NSE. Overall market breadth remained in favor of bears with 2351 declines and 1136 advances and with 140 remains unchanged. Broader market indices also closed on a negative note. India VIX surged by 5.56% to 15.19.

Nifty witnessed a good correction in the previous session. Also, prices have exactly reversed on the downside by taking resistance of the mid bands. This suggest that mid band can act as a near term resistance which can be placed at 18270. Also, prices have witnessed multiple times rejection from 18270 levels which will act as a near term hurdle. In short, as long as price holds this level, selling spree is likely to continue. As per wave perspective, current fall is in form of wave (d).

The entire structure on the downside looks like Expanding pattern. Prices have also given a breakout of double top pattern. On the other hand, MACD has also given a negative crossover. All signs are suggesting that Bears are back in action. As per wave perspective, Diametric pattern looks to be forming. It is a 7-legged corrective pattern. Currently wave d looks to have completed its course on the upside and current fall is in form of wave e.

In a nutshell, Nifty witnessed a sharp fall. It looks like Bears are back in action. For now, one can use sell on rise method to ride the trend with the targets of 17900 followed by 17800 as long as price holds 18270 on the upside.

Be a part of Master of Waves on the 7th and 8th of January which will focus on the Elliott wave, Neo wave, Hurst’s Time cycles, and also a special section on Trading using Gann square of 9. Be a part of this Elite Trading Community #wavetraders. Limited seats. Fill the form here for more details