Nifty Open Interest profile, Time Cycles 17k – 17600 Crucial!

Feb 15, 2022

Like this Article? Share it with your friends!

Nifty showed V shaped recovery after the sharp selloff seen on 14th February 2022. Prices closed back with a gain of 510 points and erased all the loses of previous day. This came after the news of conflict between Russia and Ukraine cooling off.

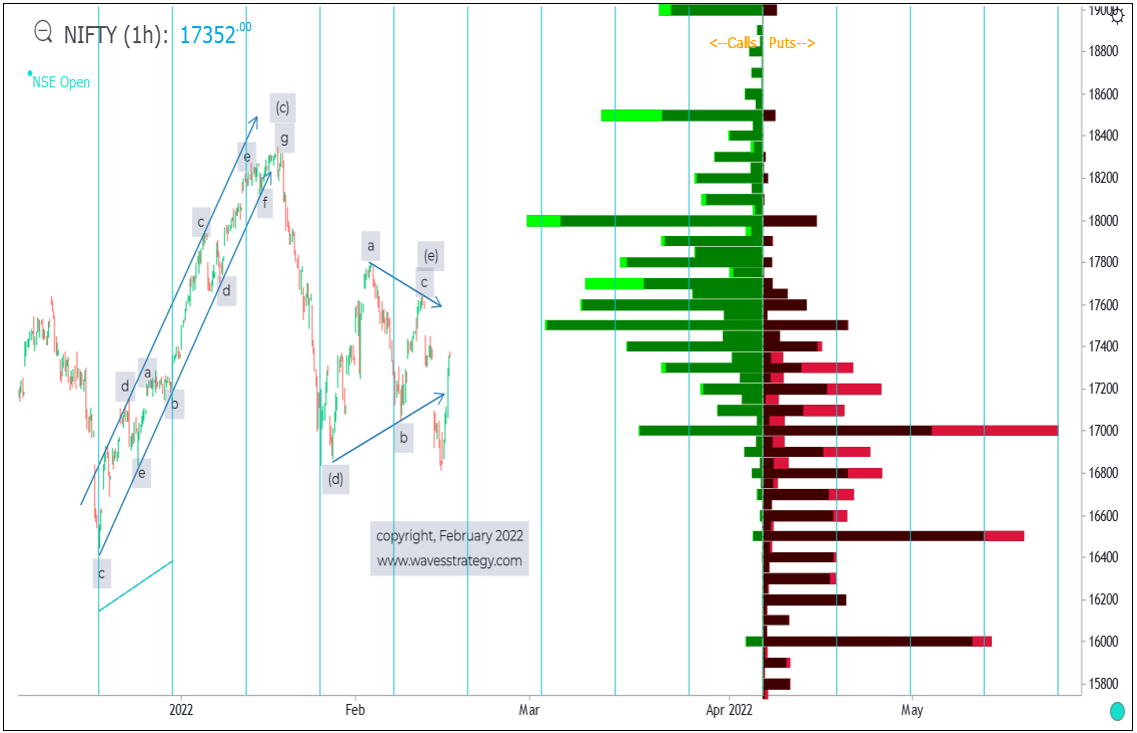

We are witnessing high volatility in either direction but non trending behavior. Below is the chart of Nifty along with hourly time cycles and Open interest profile.

Nifty hourly chart:

Open Interest profile – This shows that there is high open interest buildup on put side at 17000 and sharp change in OI. This indicates that 17k will not be a major support to market and one day of gain resulted into confidence returning back to put sellers. On upside 17500 call side OI is reducing which suggest this level might now not be a major hurdle but it is just one day of action. We can see sharp change in calls and puts sellers.

From Elliott wave perspective, we can see that the entire down move can be possibly wave (d) and wave (e) might be starting now. However, it is too soon to conclude this and we will adopt that as preferred scenario once 17600 is crossed from where the recent selloff was witnessed. Move above 17600 will suggest one push on upside is pending before the topping process is complete. Any break back below 17000 will be must for weakness from here on.

Hourly Time Cycle – Time cycle help us to understand if the price movement is in sync along with Time. We can see that this hourly Time cycle has helped capturing important lows on multiple occasions and the same is going to be due on 17th February 2nd half. So there is possibility that we can consolidate over a day or two before a decisive trending move can emerge.

In a nutshell, by combining Elliott wave, Time Cycles and OI profile one can form classic trade setups and forecasting ability. For option traders it is must to trade with time in favor for making money. 17600 is now important level to watch and 17k is major support. Expect range bound move between this zone for now before a trending move can emerge.

4 Days to Master of Cycles – MOC – Become #TimeTrader and learn to trade with Time in favor for getting the most out of Options. Unless time is in favor making money on Options is going to be challenging and above that consistency can increase sharply if you know Time techniques. Learn Hurst’s Time Cycle analysis along with Gann square of 9 on 19th – 20th February 2022 in 2 days Event of Master of Cycles. Know more here