Nifty and FII / FPI Correlation, Is it A Myth?

Aug 12, 2021

Many believe that FII / FPI are the main reasons why the markets move higher or lower. Let us take a step forward and analyse it objectively if that is the case always!

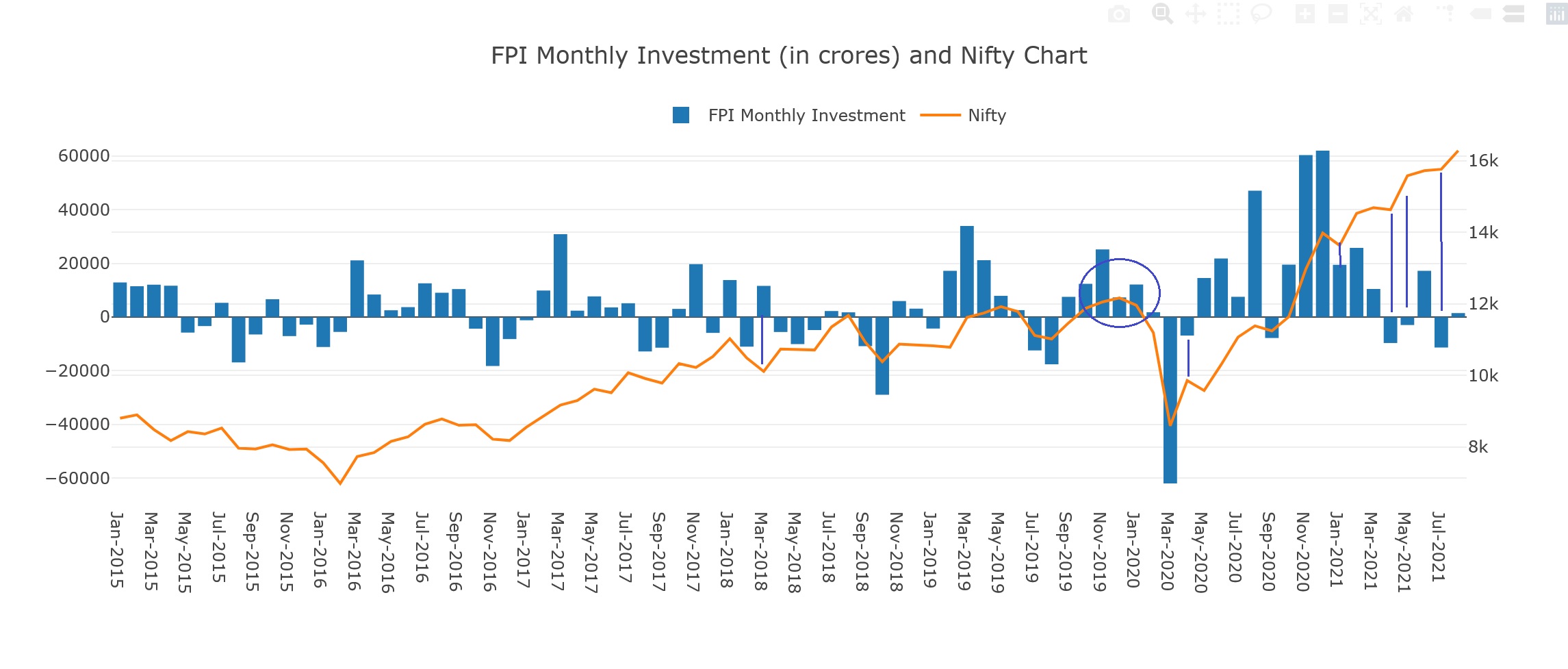

We are showing FPI Investments along with the Nifty movement, but a close look will show that there have been many instances that Nifty movement has been independent whether the FIIs are pumping in money or not. See the below chart:

FII Data with Nifty Plot

Chart source: equityfriend.com

In the above chart we have highlighted the areas where FIIs were net sellers and still market continued to move sharply higher. Also, prior to crash of March 2020 they have been net buyers in subsequent prior months. It was only in March 2020 that their selling was along with fall in the markets. It is very obvious that when big money moves in or moves out markets will move due to their buying or selling. But do understand it does not carry any forecasting ability that if FII’s have bought in a month the next month is going to be positive. This is incorrect way and does not help a trader to take a stand.

On, past instances as well we can see the Nifty has continued to move higher even when there was subdued activity by FIIs during the year 2016, 2017 and the year 2019 was majority of the times sideways despite lot of buying by FII’s.

In a nutshell FII’s do not give any early signal that we expect markets to rally or fall else they would have been net buyers all through the months prior to March 2020. The chart infact reflects that they are behaving like every other market participant and do miss out on trends like in this year and do get stuck like in March 2020.

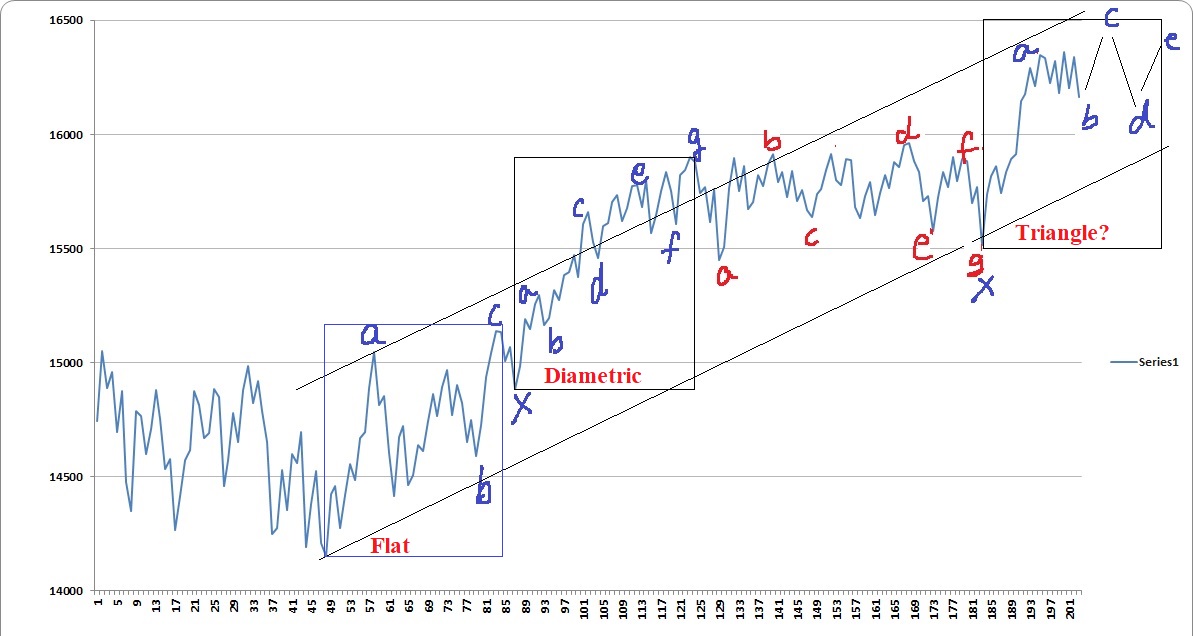

So, how can one trade if FII’s data does not provide any objective reason for one to buy or sell. It is important to see the patterns and those are in form of Elliott wave / Neo wave that carries forecasting ability. See below chart of Nifty Neo wave and by understanding the pattern one can predict what is going to happen next.

Below is Nifty Neo Plot and Path Ahead

Above chart shows different patterns forming as the market is moving higher. Interestingly each of the pattern is moving in equality and we can clearly see that from the above plot. This gives a possible target of near 16480 levels and how prices can behave in the month of August.

Power of Forecasting: It is only when we can forecast the market behaviour can we form Option trading strategy accordingly. By knowing the FII’s data is like any other indicator that can increase the conviction but nothing more. Nifty path is shown in above chart and we will see how it behaves going forward from here on. Stay tuned!

Elliott Wave / Neo Wave and Hurst’s Time Cycles – Equip with the tools and learn the above simple methods of forecasting and trading using patterns of wave theory. Join us on 4th – 5th September Online Event on Master of Waves (MOW) Season 2.2, Only limited seats, Act Now, more over here

Subscribe to the Nifty / Stocks advisory calls and get research reports free along with it that can give you an edge on trading. Visit the Pricing page here

I will be explaining Nifty Neo wave plot mentioned in the above article in much detail tomorrow at 4pm, Are you ready for learning this simple and amazing method – Book your seat now

Like this Blog? Share it with your friends!