IPCA LAB: Giving 63% returns, How to identify Multibagger stocks using Time Cycles

Sep 15, 2020IPCA Lab had been a strong outperformer within the Pharma space. The ratio analysis of Ipca lab with Pharma index shows a strong rise which clearly indicates that even when the pharma cycle had been negative this stock had continued to show multifold rise.

We published about IPCA LAB in February, 2020 and predicted a possibility of Multibagger returns in coming 2-3 years. This stock has managed to outperform the market giving almost 63% returns in just 7 months from today’s new 52 week high h near 2186 levels

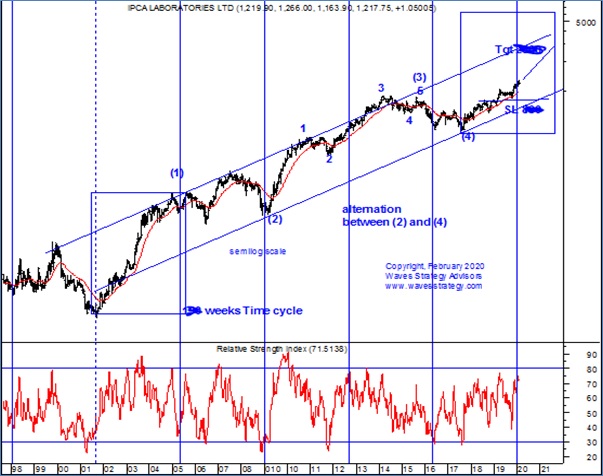

Below is the chart which shows a detailed analysis of IPCA LAB which helped to predict this target levels using Channels, Time Cycles and Elliott Wave technique. You can learn how to time the trade using Time Cycles in our MASTER OF CYCLES module

Below is the chart showing detailed analysis published in our research report -“The Financial Waves Multibagger Update”

IPCA Lab Weekly chart 🙁 Anticipated as on 13th February 2020)

IPCA Lab Weekly chart: (Happened till now)

Multibagger stock recommendation: IPCA Laboratories

Buy Price – Buy in staggered fashion at CMP 1422 and more on dips towards 1250

Time Horizon –2 to 3 years

Investment – 5% of capital

Target price –??

Stop loss – ??

Anticipated as on 13th February 2020:

Elliott wave perspective:

We are showing the weekly chart of the stock since 2000 onwards. There is a clear impulsive trend within the channel and prices are now in cycle degree wave (5). Within this cycle wave (5) we are currently moving higher in the form of primary wave 1.

Time cycle of … weeks: Prices have been forming lows every … weeks and the same cycle has now bottomed out. The above chart is of log scale and the arithmetic shows near vertical up move. During such times it is best to buy this stock in staggered fashion at CMP of 1422 and more on dips towards 1250 levels.

Channels have continued to work amazingly well and the stock might be headed towards the target of …. over next 2 to 3 years with … as the crucial stop to be maintained which is the area of prior wave (3).

P.S Levels are purposely hidden. Kindly use this article for study purpose only

Happened as on 15th September 2020 – The stock has been moving in sync with our expectation and in today’s session prices made an life time high of 2186 levels. The upmove has been strong and we expect prices to achieve its target of …..levels in coming months. The stock is giving a return in excess of 63% in 7 months of time from today’s high.

As a long term buyer of equity one should not wish for market to go up in straight line. It’s the volatility that creates opportunity to earn exponential returns. Get access to our Multibagger report to know here to invest next! That will help you capture such strong trend and earn exponential returns even in such market conditions. Check here.

We have been doing lot of research on Cycles for more than a decade. Time Forecasting is most important subject and very less talked about. Probably because time is a dynamic component and not easy to forecast. So for the very first time we will be discussing about Time Forecasting using Cycle analysis. In Master of Cycles module – Know more here