Gold – Will it Glitter Again? Time + Neowave

Oct 17, 2022

Like this Article? Share it with your friends!

Gold is known as an inflation hedge but the recent rise in global inflation has not resulted into the rise in Gold prices.

Gold is following its own independent Elliott wave pattern and Time Cycle.

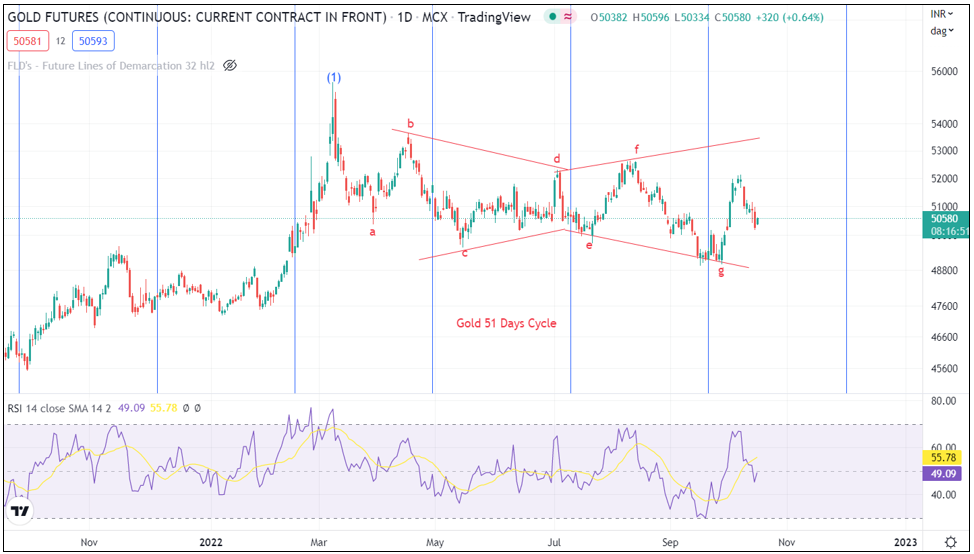

Below is chart of MCX Gold discussed during Master of Waves 18th September 2022

Gold Daily chart (anticipated on 18th September 2022)

Gold Daily chart (Happened)

Gold has been moving precisely as per Neo wave Diametric pattern and 51 Days Time cycle.

Diametric is a 7 legged corrective pattern in form of Bow – Tie or Diamond shaped. Over here we can see Gold has formed Bow – Tie Diametric pattern and completed it precisely at the 51 Days Time cycle.

Prices might be possibly starting the 3rd wave on upside but as wave (1) internally was corrective the up move can also be in corrective pattern. This means that entire rise is forming Terminal pattern and we have just started wave 3rd which can take prices beyond 56000 levels.

Time cycle of 51 Days worked out extremely well and prices bottoming out every 51 days on MCX Gold.

In a nutshell, Gold might glitter again. As long as 49000 level is intact prices might move towards 56000. Any move back below 49k will suggest few more weeks of correction before wave (3) starts higher.

Mentorship on Timing the Market – 3 Months of Trading together along with Timing the market, Algo creation, Stock selection, Risk and money management, Elliott Wave theory with access to private Telegram group for lifetime. Know more