Bank Nifty / Nifty Which Will Outperform? Sector Analysis

Feb 16, 2021

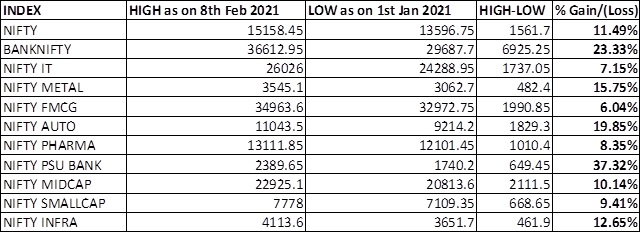

Sector performance: let us look at the Sector performance of last one month to understand which is leading and lagging and to understand the overall sentiments prevailing in the market.

Below is picked up from latest monthly research report published on 11th February 2021, For complete research get access to “The Financial Waves Monthly Update”

The above data indicates that Nifty and Bank Nifty gained (11.49%), (23.33%) respectively and that was followed by broader market participation. However important point to note down is that the current rally which started from 7511 levels was led by IT, Pharma and FMCG sector. These sector are still participating however momentum has reduced over last few months and so as the percentage gain which stands at (7.15%), (8.35%) and (6.04%) respectively. As against to the same participation in high beta sector has increased as PSU Bank sector gained (37.32%), Metals (15.75%), Auto (19.85%) and finally Infra (12.65%). This clearly states how investor’s attitude in terms of risk in the current rally has changed from pessimistic to optimistic exactly when Fundamental parameters are stating the different story which were discussed in the last monthly update!

Bank Nifty weekly chart along with Bank Nifty/Nifty Ratio Chart:

Now let’s look at the Bank Nifty/Nifty Ratio chart Figure 5, in the beginning stages of rally which started from 7511 levels in Nifty, Bank Nifty was a major underperformer due to the clarity awaited on Moratorium period by RBI. However in the month of October 2020, story changed wherein Bank Nifty started to move sharply higher and outperformed the Nifty. The Bank Nifty/ Nifty ratio which was standing still near 2.00 level, broke above 2.1 level and has now reached towards 2.4 levels. This simply suggests that how investors have become confident about the sectors prospectus as rally is unfolding. This is positive sign for Bank Nifty for now however one should not only look at the ratio but other technical parameters to put a bet from hereon. Till ratio holds above 2.1 level, outperformance can continue whereas any move below 2.1 will be the sign of worry for broader markets.

In short, Bank Nifty is providing support to the Nifty so as other high beta sector from last few months.

Latest Monthly Research report is now published. Get access to the daily equity research for 12 months and get Monthly research report complimentary along with it. Subscribe here

3 Months of Mentorship starts in March 2021 – Learn the science of forecasting and Trading using simple powerful techniques. For more details click here