Bajaj Finance: How to Derive Path Using Advanced Tools.

Feb 27, 2025

Elliott Wave functions like a navigational tool for the market, offering traders clear guidance and helps in forecasting targets. Bajaj Finance has been moving precisely as per wave counts.

We derived a path for Bajaj Finance in our recent Sutra of Waves (SOW) training held on 22nd -23rd February 2025.

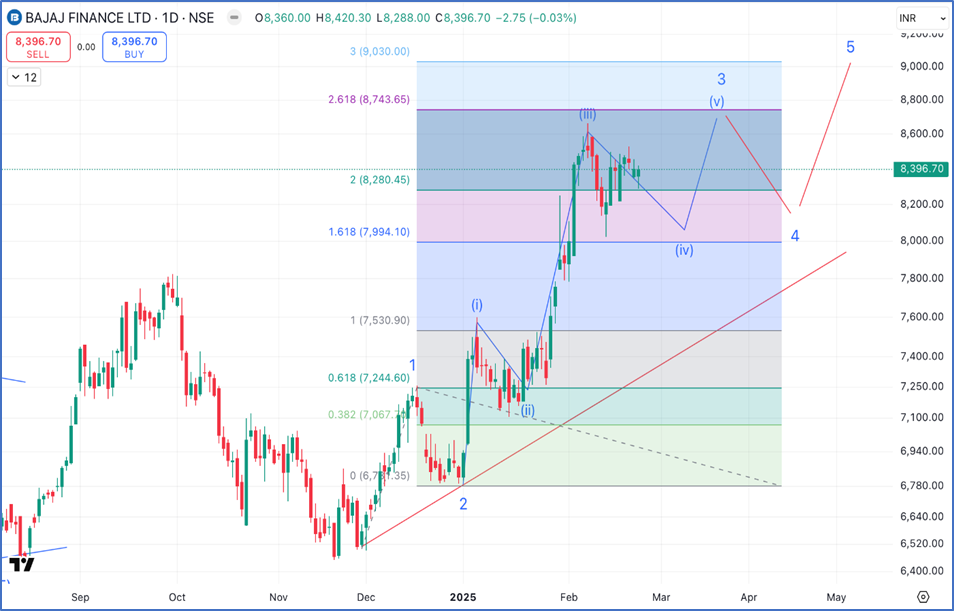

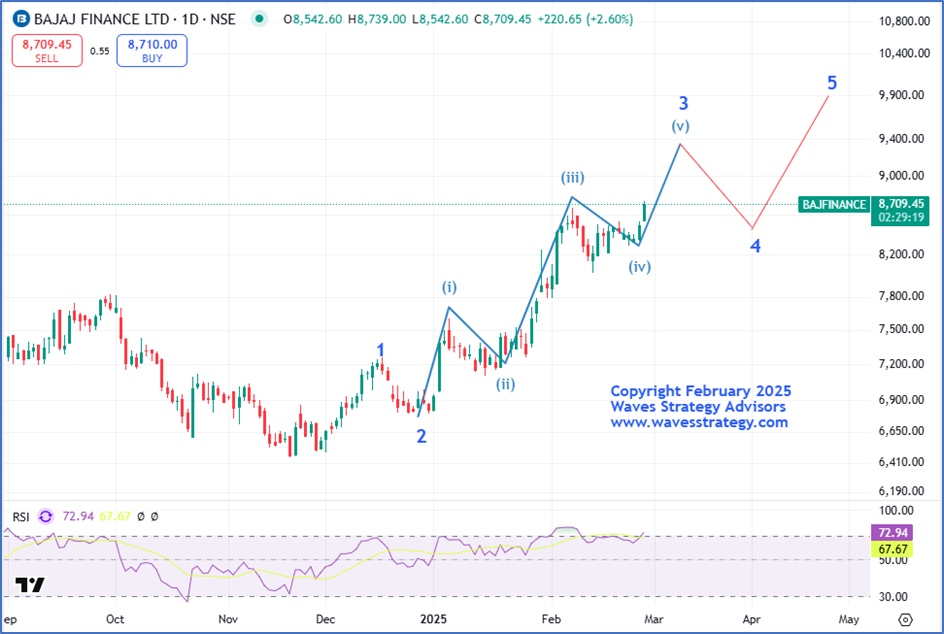

Bajaj Finance Daily chart: Anticipated as on 22nd February 2025 Bajaj Finance Daily Chart: Happened as on 27th February 2025.

Bajaj Finance Daily Chart: Happened as on 27th February 2025.  Bajaj Finance have shown classic impulse rise and been in sync with our Elliott wave counts. We expected wave (iv) to get completed on the downside once stock breaks above its previous swing high level of 8662 levels and BANG ON!!

Bajaj Finance have shown classic impulse rise and been in sync with our Elliott wave counts. We expected wave (iv) to get completed on the downside once stock breaks above its previous swing high level of 8662 levels and BANG ON!!

The stock moved as expected and completed wave (iv) on the downside and have been extending its gains despite major indices falling which is a strong positive sign. Bajaj Finance gained more than 5% in past 2 trading sessions. The current rise is in the form of (v) of primary wave 3. For now, we expect Bajaj Finance to continue to outperform and make fresh highs.

Elliott wave helps to understand the maturity of the trend and helps to capture early reversal which can we can see clearly above. These advanced tools can act like a roadmap for traders which can help them trade with accuracy.

In nutshell, for now, we can expect this rise to continue in Bajaj Finance in form of internal wave (v) with the targets of 9520 levels or higher. On the downside 8300 is the nearest support which is also a recent swing low.

Brahmastra (Mentorship) on Trading – Learn the science of forecasting using Time and Elliott wave, Neo wave along with risk money management, stock selection algo, Options trading with complete plan. Limited seats only, Next batch starts in March 2025. Fill below form for more details: